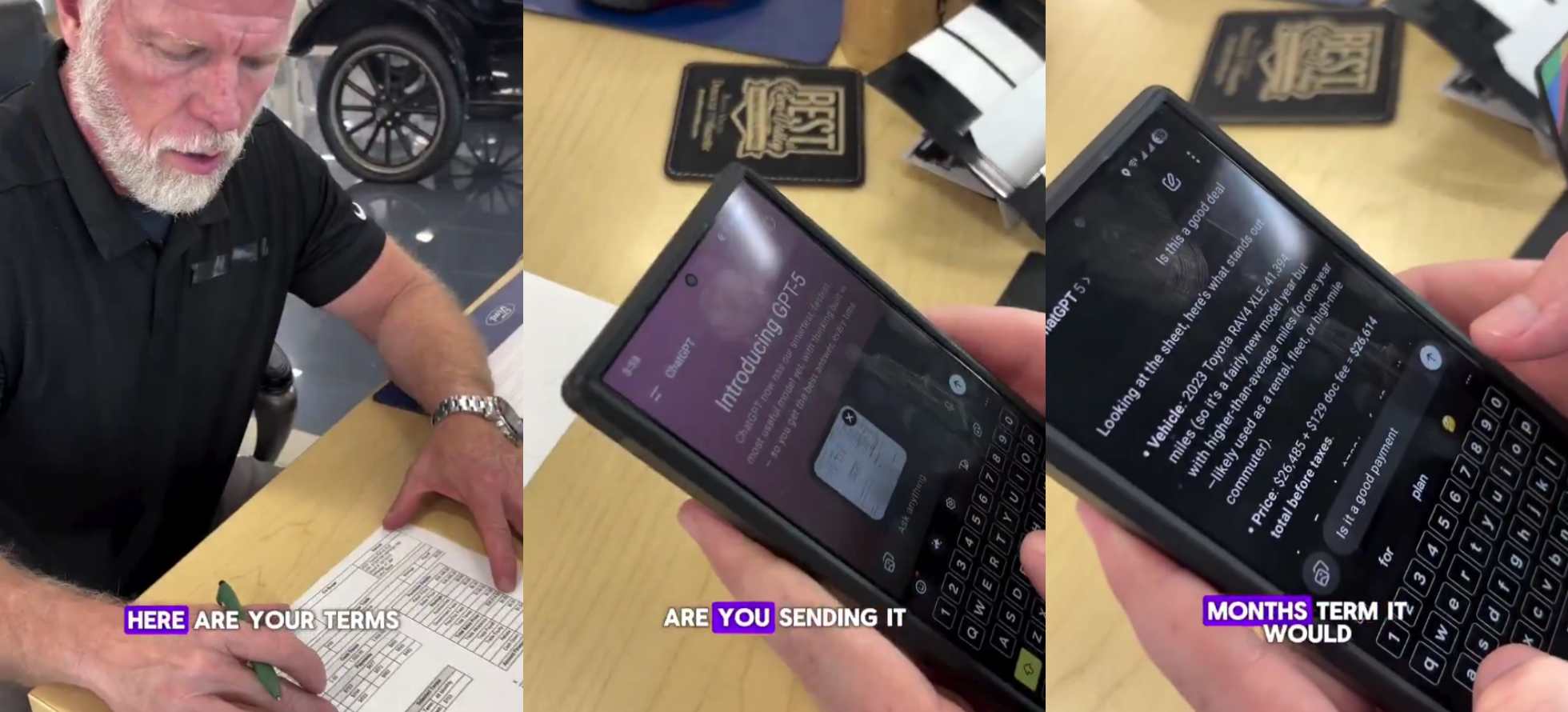

A new trend is emerging at car dealerships across the country: young buyers pulling out their smartphones and feeding financing contracts into AI chatbots before putting pen to paper. Gen Z consumers are increasingly turning to artificial intelligence tools like ChatGPT to decode the complex language of auto loans, refusing to sign deals until they understand exactly what they’re agreeing to.

Rather than relying solely on salespeople’s explanations or struggling through dense legal terminology themselves, they’re using AI to level the playing field with sophisticated dealers who have decades of experience crafting profitable terms.

Social media discussions around this phenomenon reveal widespread support for the approach. Many users praise the strategic thinking behind using AI as a contract review tool, with several noting that dealerships often make more profit from financing terms than from the vehicles themselves. Industry insiders have confirmed this reality, with former car salespeople revealing that dealers routinely inflate interest rates by a percentage point or two to increase their cut.

The AI assistance appears to be delivering real value. Users report that these tools excel at identifying non-standard contract provisions and translating complex legal language into plain English summaries. This capability is proving particularly valuable in an industry where information asymmetry has traditionally favored dealers over consumers.

For decades, various industries have built profit models around taking advantage of customers who lack the expertise to fully understand complex contracts and terms. The democratization of contract analysis through AI threatens to disrupt these established dynamics.

Not everyone sees the development as entirely positive. Some critics worry about the implications of outsourcing critical thinking to automated systems, questioning what might go wrong when important financial decisions depend on AI interpretation rather than human analysis.

The practice has sparked conversations about alternative financing approaches altogether. Many financial experts continue to advocate for credit union loans over dealer financing, noting that consumers can often secure better rates through traditional lenders. However, dealer incentives and special promotional rates sometimes make their financing competitive, creating a complex decision matrix that AI tools can help navigate.

The phenomenon extends beyond just Generation Z, with older consumers expressing interest in adopting similar approaches. The appeal crosses generational lines, suggesting that AI-assisted contract review could become standard practice for major purchases.

Auto financing terms have become increasingly complex, with loan periods stretching to 72 months or longer becoming commonplace. The extended terms and intricate fee structures make professional-level contract analysis more valuable than ever for typical consumers.