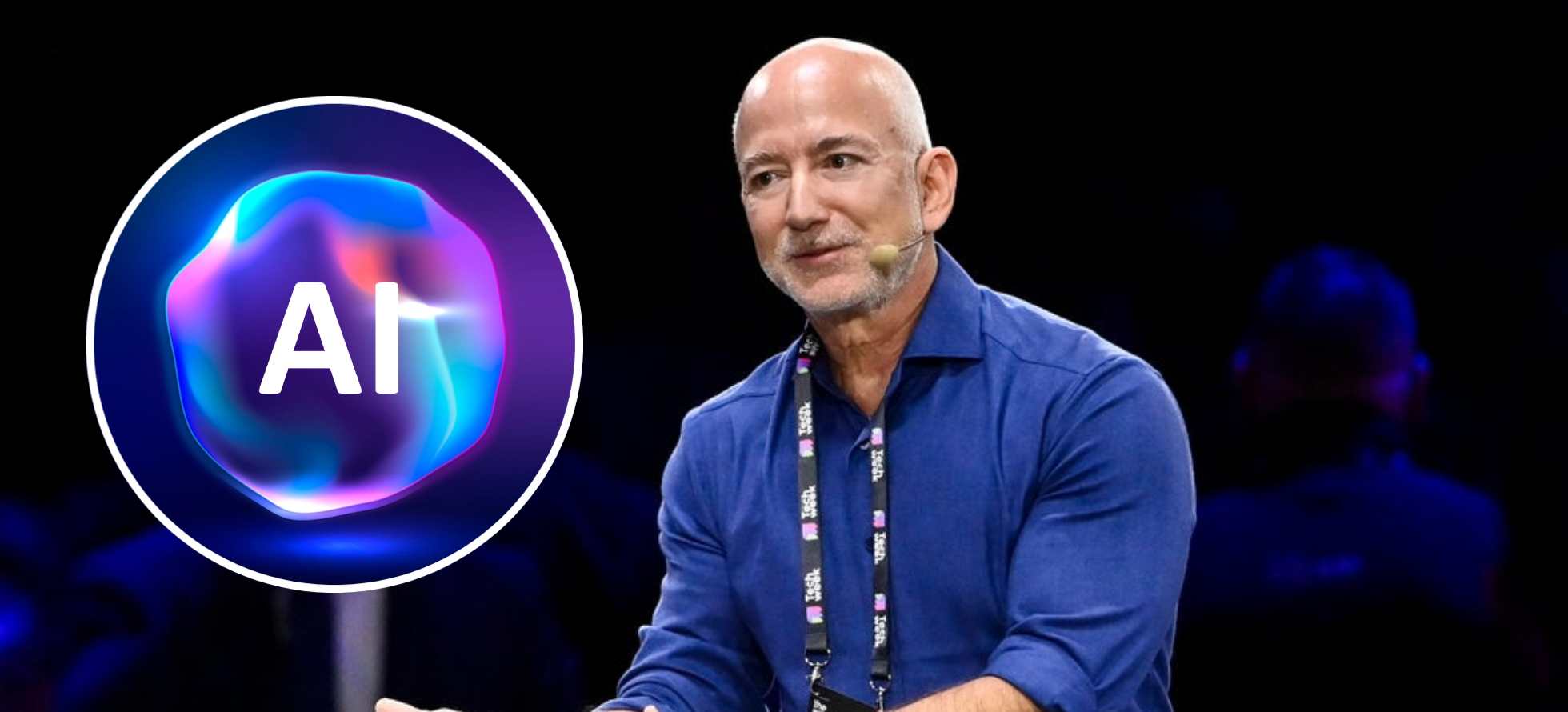

Amazon founder Jeff Bezos recently drew parallels between today’s artificial intelligence boom and the infamous internet bubble of the early 2000s, but he managed to frame this potentially troubling comparison as a reason for optimism rather than concern.

Speaking at Italian Tech Week 2025, Bezos recalled how Amazon’s stock price plummeted from $113 to $6 per share during the internet bubble burst in 2000. Despite this dramatic collapse, he emphasized that Amazon’s fundamental business metrics—customer growth, gross profits, and operational efficiency—continued improving throughout the crisis.

“The fundamentals can be disconnected,” Bezos explained, noting that entrepreneurs should focus on building substantial businesses rather than chasing stock valuations.

Bezos acknowledged that the current AI landscape mirrors that earlier bubble period, particularly in how “every experiment gets funded” and “every company gets funded,” making it difficult for investors to distinguish between promising ventures and poor ideas. He pointed to the unusual phenomenon of six-person teams receiving billion-dollar valuations with no product as evidence of bubble-like behavior.

However, rather than sounding alarm bells, Bezos reframed this comparison through his concept of “industrial bubbles” versus “financial bubbles.” While financial bubbles like the 2008 banking crisis offer no societal benefit, industrial bubbles ultimately advance human progress despite the inevitable casualties. He cited the 1990s biotech bubble as an example—though most companies failed, society still benefited from life-saving medicines that emerged from the period.

According to Bezos, AI represents a particularly powerful industrial bubble because it’s a “horizontal enabling layer” that will transform every company across all industries. Unlike previous technology waves that primarily created specialized AI companies, he predicts AI’s greatest impact will come from enhancing productivity and quality across manufacturing, hospitality, consumer products, and virtually every other sector.

Perhaps most tellingly, Bezos drew parallels to the internet bubble’s infrastructure legacy. The fiber optic cables laid by companies that subsequently went bankrupt became the foundation for today’s digital economy. Similarly, he suggests that today’s massive AI investments, even those made by companies destined to fail, will create lasting infrastructure and breakthroughs that society will eventually inherit and benefit from.

By framing the AI bubble as an inevitable step toward genuine transformation, Bezos managed to acknowledge market irrationality while simultaneously arguing that it serves a greater purpose. He suggested that even if we’re in a bubble, we should embrace it as the messy but necessary path to genuine technological advancement.