What started as a fairly routine data analysis quickly turned into a public feud.

According to sources, an equity analyst examined betting results and concluded that users of fast-growing prediction markets were burning through money more quickly than gamblers on mainstream betting apps.

Soon after, Kalshi Inc., the largest prediction market in the US, went on the offensive. The company told Bloomberg that the analysis was not only incorrect, but tied to what it described as an “extortion” attempt involving the startup that supplied the data.

Juice Reel, the small analytics firm at the center of the dispute, flatly rejected that claim. Its founder said Kalshi’s accusation was a “complete fabrication,” and countered that Kalshi itself had attempted to pressure him into discrediting the numbers.

Within hours, Kalshi softened its position, saying it still disagreed with the conclusions but that “after further review, we don’t believe the intention was extortion.” The company also denied trying to coerce Juice Reel into backing down.

The episode offers a glimpse into the increasingly aggressive battles unfolding in online betting. Startups are competing for users, funding and credibility in a US gambling market estimated at $200 billion.

The analysis that sparked the controversy was always likely to provoke backlash. Jordan Bender, an equity research analyst at Citizens, examined early user behavior on prediction markets and found that during their first three months, participants were losing a larger share of their wagers than users on established sportsbooks such as FanDuel and DraftKings.

That finding runs directly against Kalshi’s marketing narrative, which portrays prediction markets as a fairer alternative to traditional gambling.

Kalshi and similar platforms operate federally regulated exchanges that let users trade contracts tied to real-world outcomes, ranging from elections to major sporting events. Unlike sportsbooks, they claim not to take the opposite side of bets, instead matching traders against each other in what they describe as a more transparent marketplace.

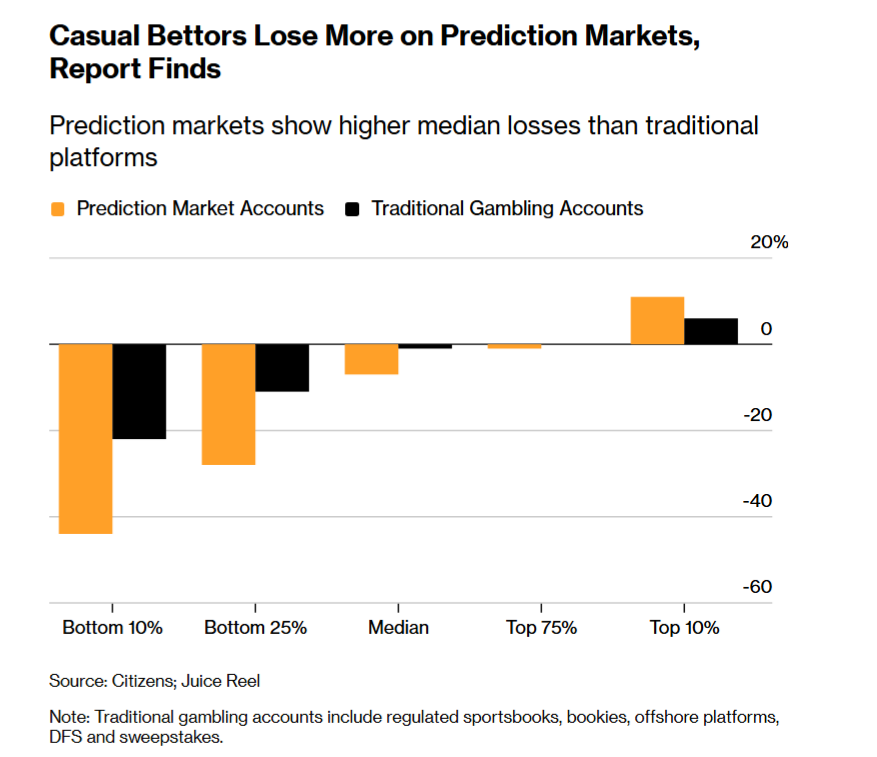

According to Bender’s research, losses were most severe among inexperienced users. The bottom 25% of participants lost roughly 28 cents for every dollar wagered in their first three months on prediction markets, compared with about 11 cents per dollar on conventional gambling platforms. For the bottom 10%, losses during the first 90 days approached 44%.

The underlying data came from Juice Reel, an app that aggregates transaction histories to help gamblers track their performance across multiple platforms.

Kalshi initially dismissed the findings outright. In a statement to Bloomberg, the company said the data was “flat-out wrong” and compromised by a conflict of interest.

Elisabeth Diana, Kalshi’s head of communications, claimed Juice Reel had previously sought “investment support” from the company and alleged that its founder had offered to “defuse the situation” if granted a meeting with Kalshi’s CEO.

“Please consider the source and its motives,” she said in an emailed statement. “This is extortion.”

Ricky Gold, Juice Reel’s 32-year-old CEO, said he was surprised by the accusation. He told Bloomberg that Kalshi was the party that initiated contact after the report circulated.

“They called and messaged us, pressuring us to tell Bloomberg that our data is inaccurate,” Gold said. “We stand for transparency, we stand for helping bettors, traders understand their activity across the platform, and we stand behind our data.”

After Gold rejected those requests, Kalshi maintained that it disagreed with the Citizens analysis but backed away from the extortion claim. Diana said the company was reviewing whether Juice Reel was legally entitled to collect Kalshi transaction data, adding that “after further review, we don’t believe the intention was extortion.”

“Every bettor and trader is entitled to access their transaction history,” Gold said in response.

Bender, for his part, stood by the work. “We are confident in our analysis of the available data,” he said. Citizens declined to elaborate further.

Bender has relied on Juice Reel’s data in prior research. In 2024, he told industry outlet Sports Handle that while the dataset was valuable for analysts, it often made gambling companies uncomfortable.

The dispute comes as Kalshi continues to post rapid growth ahead of major sporting events such as the Super Bowl. User-compiled figures from Dune Analytics show weekly trading volume on the platform exceeded $2 billion for the first time in January, up from roughly $1 billion just a few months earlier. Sports-related contracts have driven much of that surge, though users can also trade on politics, entertainment and other topics.

The expansion has intensified debate over the social impact of prediction markets. Traditional sports gambling is already associated with significant consumer losses, and both Kalshi and its main competitor, Polymarket, have been eager to distance themselves from the gambling label.

Yet Citizens’ analysis suggests prediction markets may not be gentler on users. Median losses on prediction market accounts in the Juice Reel dataset were about 7% of money wagered during the first 90 days, compared with roughly 1% across other forms of gambling.

Kalshi did not release figures to counter the report but said its “internal data directly contradicts” the findings, claiming average user losses were “significantly lower than 7%.” The company also argued that the conclusions “defies logic,” citing academic research from the University of Chicago and Stanford showing sports gamblers lose about 7.5% per dollar wagered.

Gold said he reviewed the data again after the controversy erupted and found no errors.

Bender has previously noted that Juice Reel users tend to be relatively seasoned gamblers, but likely exclude professional trading firms and sophisticated bettors who have begun operating on prediction markets and are expected to capture a disproportionate share of profits.

In his latest report, Bender suggested that those advanced players, combined with less favorable pricing, could explain why casual users fare worse on prediction markets than on sportsbooks, where the house absorbs risk on every wager.

“Prediction markets are creating worse losses for the worst users, while more educated bettors are winning more,” he wrote.

Kalshi disputes that characterization and says its pricing is more competitive than that of traditional gambling companies.

The firm has stepped up efforts to position prediction markets as a superior alternative to conventional betting. It recently hired John Bivona, a former congressional staffer, as head of federal government relations.

In a LinkedIn post last week, he wrote that “Kalshi has built a platform where there is no system: no algorithm, no house, no Wall Street. People decide the price and compete fairly against each other.”

Despite those claims, a growing number of state regulators have moved to block prediction markets, arguing they amount to illegal gambling and lack sufficient consumer safeguards. However, the companies have pushed back and continue to operate nationwide.