A fierce price war is reshaping China’s weight-loss market as companies slash costs by up to 80 percent to capture their share of a rapidly expanding sector. The competition intensified following the 2024 approval of obesity treatments from global leaders Novo Nordisk and Eli Lilly, with both foreign and domestic manufacturers now racing to establish dominance before a critical patent expiration arrives in March.

According to sources, the dramatic price reductions began accelerating in late December when Novo Nordisk cut Wegovy prices in half across provinces including Yunnan and Sichuan, according to local media reports. Monthly treatment costs for the highest doses of Wegovy, a weekly semaglutide inj**tion, plummeted from approximately 1,900 yuan (US$272) at launch to below 1,000 yuan. Online retailers quickly followed suit, with JD.com listing Eli Lilly’s Mounjaro 2.4-millilitre dose for around 500 yuan. This is an 80 percent reduction from its original price.

“Defending market share takes precedence over margins,” said Cui Cui, head of healthcare research for Asia at US investment bank Jefferies. “Weight-loss d**gs carry high gross margins, enabling manufacturers to absorb price reductions.”

The aggressive pricing strategies have caught industry observers by surprise. “Multinational corporations cut prices faster and deeper than our expectation to compete in this market,” said Zhang Jialin, Nomura’s head of China healthcare research. “Local peers should follow.”

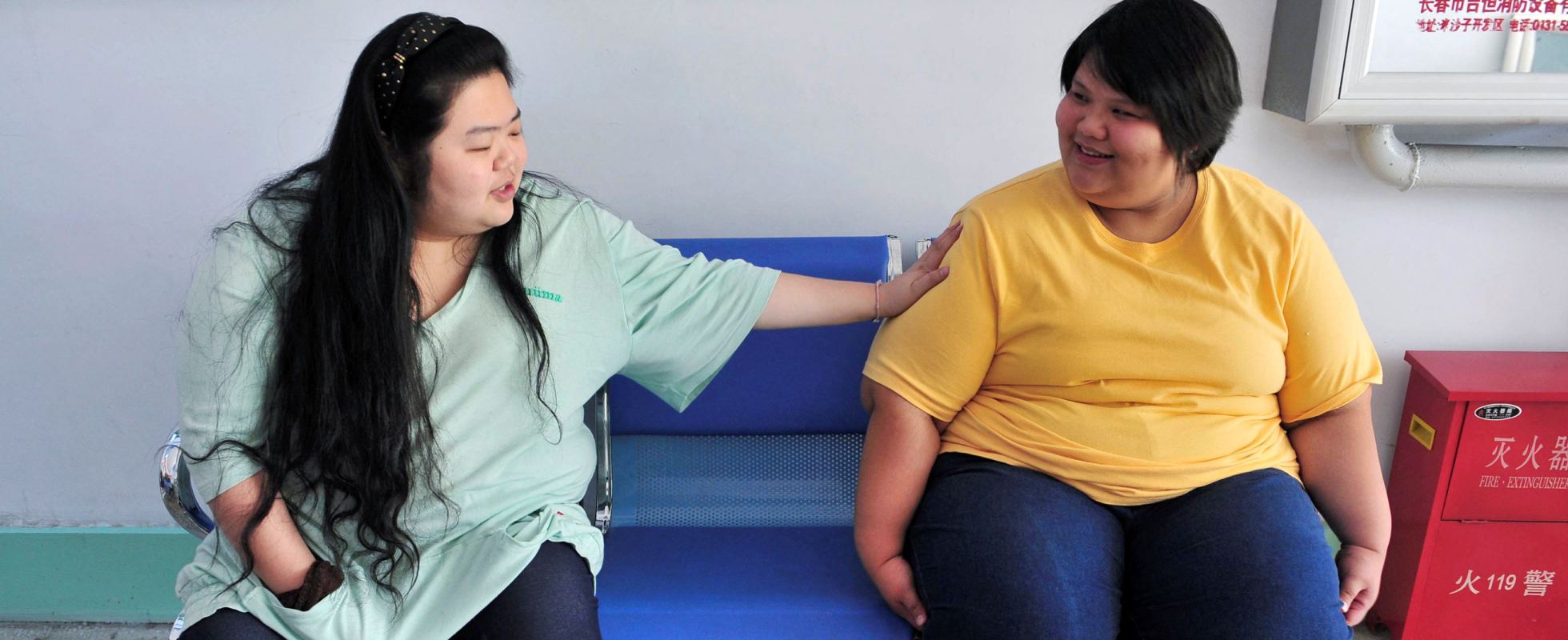

The stakes are particularly high as China confronts a looming obesity crisis. A Lancet study revealed that more than 400 million adults in the country were overweight or obese in 2021, a figure projected to swell to approximately 630 million by 2050. The economic burden of addressing this health challenge could reach an estimated 418 billion yuan.

Chinese companies are positioning themselves to capitalize on both the growing demand and upcoming patent expirations. Boston-based L.E.K. Consulting reports that over 60 GLP-1 candidates are currently in late-stage clinical trials in China, potentially creating serious competition for established treatments like semaglutide and Mounjaro.

Innovent Biologics made an early move in January by reducing the price of mazdutide, China’s first domestically developed obesity treatment approved last June, by approximately 40 percent. The medication’s monthly cost for the highest dosage dropped from 2,920 yuan to a more accessible level.

However, analysts caution that Chinese manufacturers face unique challenges despite their pricing advantages. “Chinese firms will have to price their d**gs even lower, as they do not have the halo effect of large global studies to corroborate their efficacy,” said Tony Ren, head of Asia healthcare research at Macquarie Capital. “Obesity in China could ultimately become a consumer-focused, recreational and aesthetics play.”

The outlook for domestic producers remains mixed. Yang Huang, head of China healthcare research at JPMorgan Chase, warned that smaller GLP-1 d**g producers in China might struggle to survive under such intense competition.

Yet some Chinese companies show promising prospects. Macquarie Capital projects mazdutide could achieve peak sales of 8.6 billion yuan by 2031, with 80 percent of revenue coming from obesity treatment and the remainder from diabetes medications.

The pipeline of domestic alternatives continues to expand. CSPC Pharmaceutical Group’s TG103, a once-weekly GLP-1 Fc fusion protein, is preparing for regulatory approval. Jiangsu Hengrui Pharmaceuticals completed Phase III trials for HRS9531 and submitted a new d**g application last year. Meanwhile, Huadong Medicine has finished Phase III trials for both a semaglutide injection and an oral GLP-1 agonist for weight management indications.

Even as multinational companies reduce prices to maintain their foothold, they are hedging their bets. Novo Nordisk paid US$200 million in March last year to China’s United Laboratories for global rights, excluding Greater China, to a d**g targeting obesity, type 2 diabetes, and other metabolic disorders, a strategic move to offset potential revenue losses from patent expirations.

The price reductions mark a massive shift in accessibility for Chinese consumers seeking weight-loss treatments, though the long-term sustainability of such steep discounts remains uncertain as more competitors enter the market.