When Sam Altman testified before Congress about artificial intelligence regulation, he presented himself as a different kind of tech CEO. Asked about his compensation, the OpenAI chief executive offered a striking response.

“I make, no. I’m paid enough for health insurance, I have no equity in OpenAI,” Altman told Senator John Kennedy. When the senator expressed surprise, Altman added: “I’m doing this because I love it.”

That simple declaration helped shape public perception of Altman as a mission-driven leader prioritizing humanity’s future over personal wealth. However, recent revelations from legal proceedings paint a more complex picture of his financial arrangements with the company behind ChatGPT.

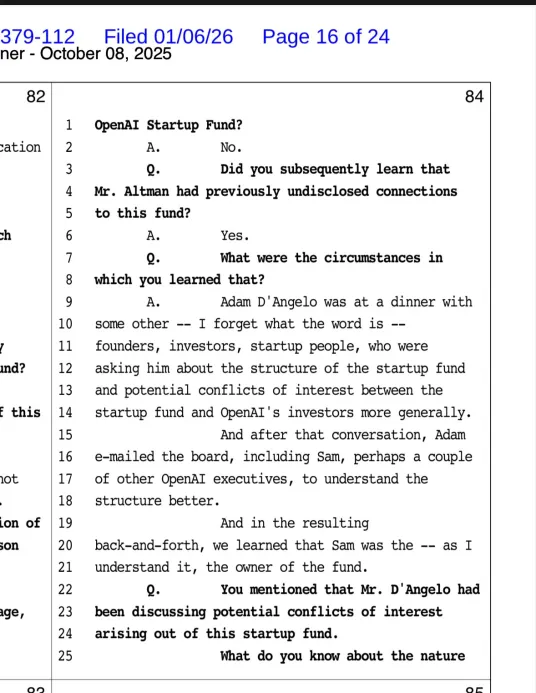

Court documents from Elon Musk‘s lawsuit against OpenAI reveal that Altman maintained previously undisclosed connections to the organization’s investment vehicles. According to deposition testimony, board members learned that Altman owned the OpenAI Startup Fund, a discovery that caught even directors by surprise.

The fund’s ownership structure came to light after board member Adam D’Angelo attended a gathering with entrepreneurs and investors who questioned him about potential conflicts of interest. Following that conversation, D’Angelo contacted other board members seeking clarification about the fund’s arrangements.

“In the resulting back-and-forth, we learned that Sam was the owner of the fund,” the witness testified, referring to Altman’s control of the investment vehicle.

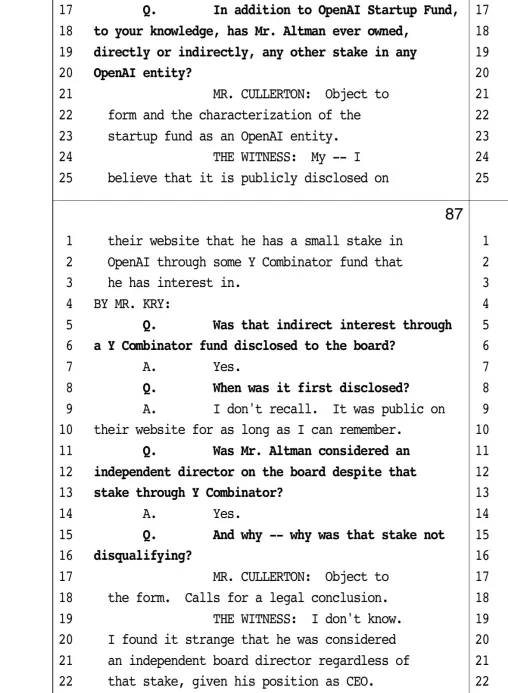

Additionally, testimony confirmed that Altman held an indirect financial interest in OpenAI through a Y Combinator fund, the startup accelerator he previously led.

While this connection was reportedly disclosed on OpenAI’s website, the timing and transparency of that disclosure raised questions among those familiar with corporate governance standards.

“I don’t recall” when the Y Combinator stake was first disclosed to the board, the witness stated, though noting it appeared on the company’s website “for as long as I can remember.”

Perhaps most notably, despite these financial connections, Altman was classified as an independent board director, a designation typically reserved for members without significant financial ties to an organization.

“I found it strange that he was considered an independent board director regardless of that stake, given his position as CEO,” the witness testified.

These revelations arrive as Altman expands his influence across multiple technology ventures. Beyond leading OpenAI, he backs Worldcoin, a digital identification project that scans users’ eyeballs, and is now reportedly launching Merge Labs, a brain-computer interface company intended to rival Neuralink.

The brain-chip venture brings Altman into direct competition with his former collaborator Musk, with whom he co-founded OpenAI in 2015 before their acrimonious split three years later. According to the Financial Times, Merge Labs seeks $250 million in initial funding, much of it expected from OpenAI’s ventures arm, for a valuation of $850 million.

Musk’s Neuralink, founded in 2016, has already implanted chips in seven patients in the United States and recently received approval for trials in Britain. The technology allows paralyzed individuals to control computers through thought alone by reading electrical signals from the brain.

Altman articulated his interest in brain-computer interfaces in a 2017 blog post titled “The Merge,” suggesting humans and machines would become one between 2025 and 2075.

“My guess is that we can either be the biological bootloader for digital intelligence and then fade into an evolutionary tree branch, or we can figure out what a successful merge looks like,” Altman wrote.

The expanding scope of Altman’s business interests contributed to tensions that erupted in November 2023 when OpenAI’s board terminated him, citing that he was “not consistently candid in his communication.” Though he returned five days later after employee backlash and board restructuring, the episode highlighted concerns about transparency at the company shaping artificial intelligence’s future.

The contrast between Altman’s congressional testimony and the subsequent disclosures underscores ongoing debates about conflicts of interest in rapidly growing technology companies.

Neither OpenAI nor Altman has publicly addressed the discrepancies between his testimony and the documented financial arrangements