During a recent episode of the All-In Podcast, venture capitalist David Friedberg delivered an analysis on America’s fiscal trajectory and its potential social consequences. His commentary, sparked by discussion of civil unrest in Minneapolis, connected government spending, dollar devaluation, and growing wealth inequality to the risk of future conflict.

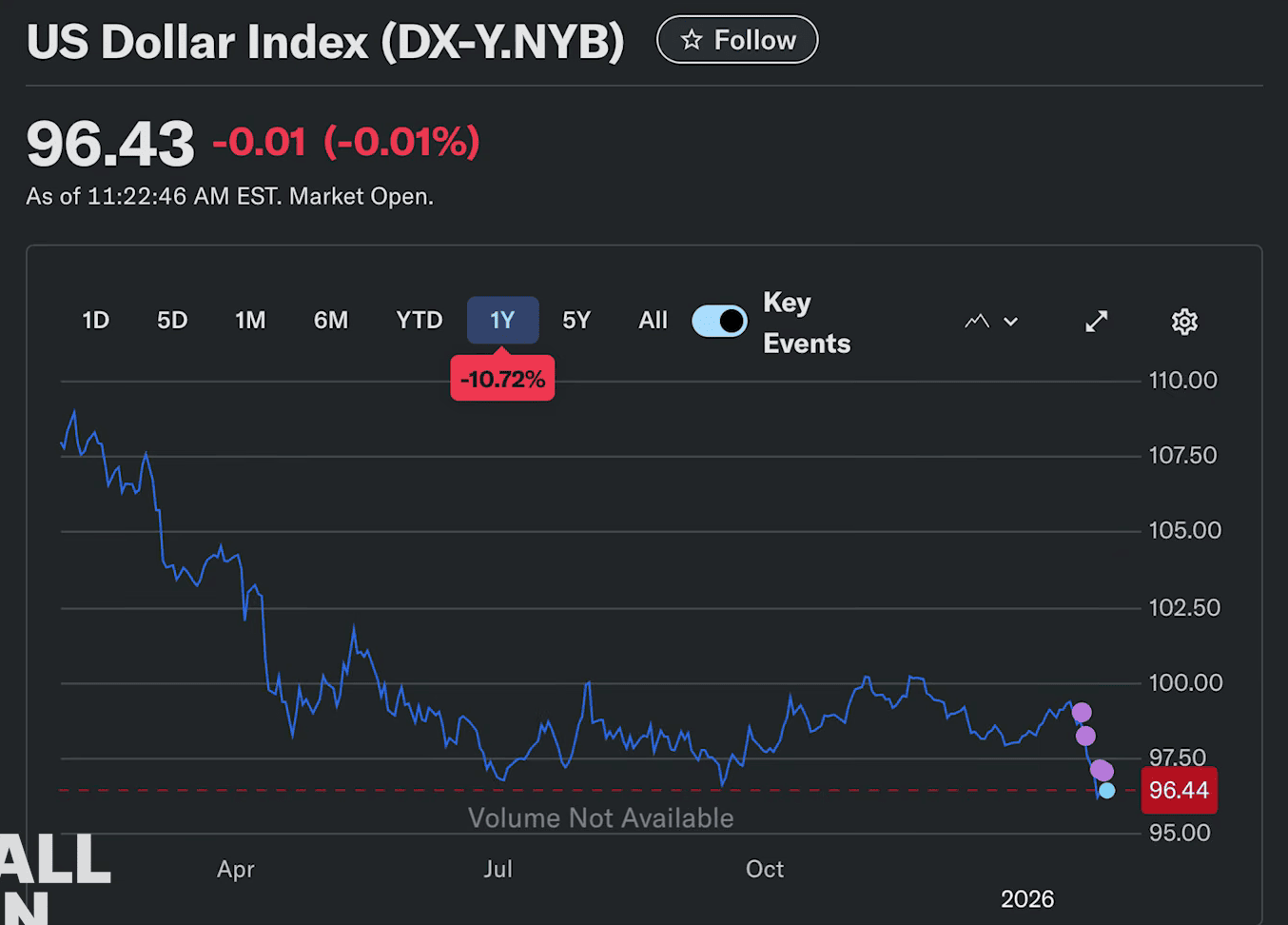

Friedberg began by presenting data on the declining dollar. “This is the dollar index. So it’s the dollar against a basket of foreign currencies has declined from an index of about call it 109 down to 96 today,” he explained, before making a striking observation about stock market performance when measured in real assets rather than inflating currency.

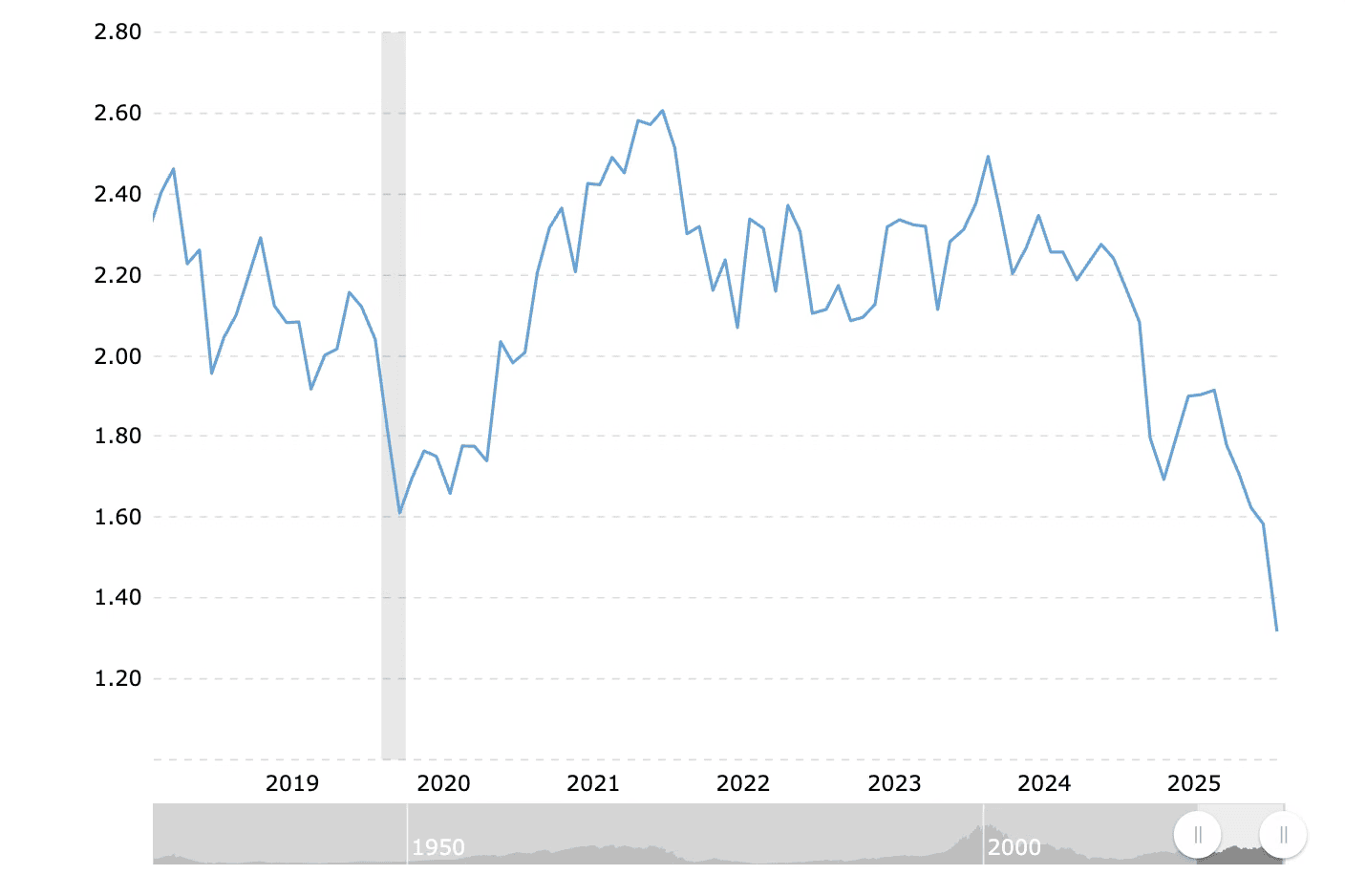

“If we had the gold standard still and if we functionally converted stock market value from dollars back into gold, you can see that the stock market in the United States over the past years, so this is about seven and a half years going back to the pre-COVID era, is actually down,” Friedberg noted.

He continued: “Everyone’s cheering, clapping, bouncing up and down. Stock markets are up. Stock markets are up. The stock market’s up in dollar denominated terms. But if you look at the stock market relative to gold, it’s actually down.”

The venture capitalist then connected this monetary phenomenon to the federal government’s mounting debt crisis. “The 30-year yield is now at 4.9%. The average US government’s cost to borrow today is 3.3%. So if we end up needing to roll all of the US government debt, assuming we take on no new debt, which we know is not the case, $39 trillion of debt outstanding, the federal government level today, and it had to get refinanced at this rate, we would have an incremental annual cost to service the debt, just the interest on the existing debt, of roughly $700 billion a year,” he calculated.

Most significantly, Friedberg argued that dollar devaluation creates a fundamental divide in American society between asset holders and wage earners. “If you own assets like we do, the four of us, we own stocks, we own real estate, we own other assets. As the dollar devalues and everything inflates in value, our asset prices go up and we get wealthier and wealthier and wealthier. The majority of Americans do not own assets. They are net asset negative. As a result, they live off of income and they do not benefit from the de-dollarization like asset holders do.”

He connected this economic reality directly to current political tensions. “This is what is ultimately fueling populism in the United States. And the populism in the United States is what is driving socialism. And the response to those behaviors is what Donald Trump elected to some degree. And the response to the Donald Trump actions is what’s driving the civil unrest in Minnesota and other places.”

In perhaps his most striking admission, Friedberg revealed a personal evolution in his thinking. “I was kind of at the gym this morning on the treadmill. And while I was there, I was actually thinking about the wealth tax stuff that’s going on in California. And I wonder if it may be an inevitability in order to keep the United States from going into civil war. I mean that very wholeheartedly.”

He continued: “Like I just don’t know if there’s a way of solving this fiscal problem without a functional redistribution of wealth. And the question is can you do it violently or nonviolently? And if there’s a nonviolent path, I think that’s probably the preferable path.”

Co-host David Sacks pushed back on the effectiveness of wealth redistribution through government, questioning where California’s wealth tax revenues actually flow. Friedberg acknowledged the concern, noting that when capital moves through centralized systems like government, “you end up most seeing a large percentage of it go into theft back into the hands of a few who were really good at capturing that money as it comes out of the government’s coffers.”

The discussion revealed growing concerns among even wealthy technologists about America’s fiscal sustainability and social cohesion. Friedberg’s comments represent a acknowledgment from a venture capitalist that some form of wealth redistribution may become necessary to preserve civil order.