Elon Musk’s announced this week that Tesla will wind down production of its Model S and X vehicles to make room for Optimus humanoid robots at the Fremont factory. It’s a massive bet on a technology that doesn’t yet have a proven market. However, the suppliers most likely to profit are already ramping up production, many of them based in China.

The numbers tell a compelling story. Tesla plans to produce one million Optimus robots annually at its Fremont facility once full-scale manufacturing begins. They have even higher volumes planned for Giga Texas. At a targeted manufacturing cost of around $20,000 per unit, that’s a $20 billion annual production run at Fremont alone. According to Morgan Stanley, the global humanoid robot component market could balloon to $780 billion by 2040.

According to sources, Chinese suppliers are set to capture the lion’s share of this opportunity. Cheng Xin of Bain & Company notes that Chinese players hold 50 to 70% of manufacturing and core component production expertise for humanoid robots, accounting for at least 55% of the global bill of materials in some critical components.

Tesla has been cultivating relationships with hundreds of Chinese component suppliers for at least three years, involving them in research and development, hardware design, and prototype components including Optimus’ distinctive curved-glass head.

The supplier list includes: Zhejiang Sanhua Intelligent Controls for thermal management and joint-drive systems; Ningbo Tuopu Group for actuators, motors for dexterous hands, and electronic skins; Leaderdrive for harmonic gearing devices; and Seenpin Electromechanical Transmission and Beite Technology Group for planetary roller-screws. Others like Shuanghuan Driveline, CSB, and Xusheng are positioned to supply precision gears, bearings, and joint housing.

Tesla is making this pivot as it reports its first-ever annual revenue decline, with vehicle production falling 7 percent year-on-year in 2024 as Chinese EV manufacturers surge ahead in the electric vehicle market. Rather than doubling down on cars, Musk is shifting the company’s focus to what he describes as an “autonomous and epic” future.

“We’re really moving into a future that is based on autonomy,” Musk said during Tesla’s fourth-quarter financial report, calling the discontinuation of the Model S and X lines “slightly sad” but necessary for the company’s evolution. He emphasized that buyers interested in these models should order now, as production will cease next quarter.

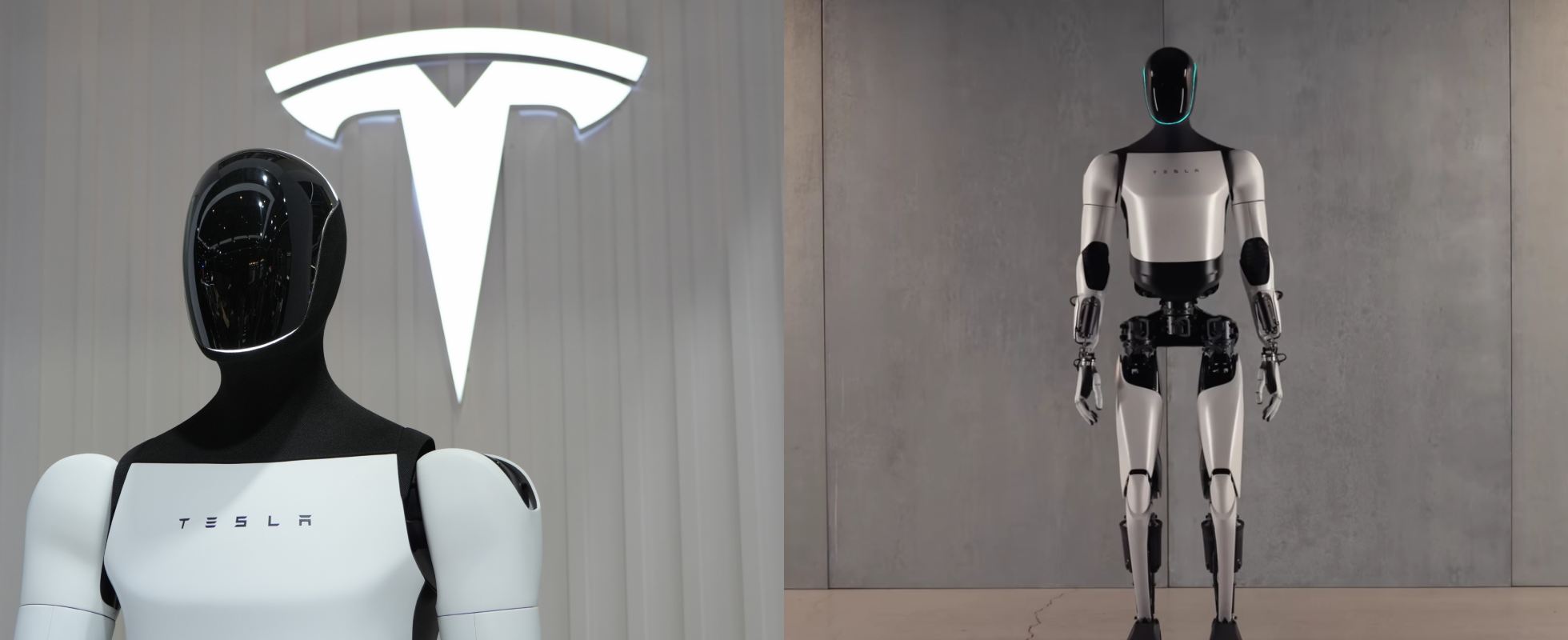

The upcoming Optimus 3, which Musk says will be unveiled in a few months, represents a major technological leap. According to Musk, it will be a general-purpose robot capable of learning by observing human behavior, responding to verbal descriptions, or even replicating tasks shown in videos.

“It’s going to be a very capable robot,” Musk declared. “I think, long-term, Optimus will have a very significant impact on the U.S. GDP.”

But here’s the catch: mass production isn’t planned until the end of 2026, and Musk himself admitted that Optimus’ factory performance is currently at a “very early stage.” Meanwhile, Chinese suppliers are already investing in expanded production capacity without firm large-scale orders or a definitive mass production timetable.

Zhang Xin of Longbridge Dolphin Research points to the fundamental advantages that make Chinese suppliers attractive to Tesla: “Cost and efficiency remain the Chinese supply chain’s key advantages.”

Zhang notes that Tesla’s supplier selection process prioritizes technology, cost, mass production experience, responsiveness, and overseas manufacturing capacity, regardless of company size. Given that even minor design changes can cause significant swings in component demand, this flexibility is necessary.

Interestingly, China’s total bill of materials for humanoid robots is expected to fall 16% this year, potentially making Chinese components even more cost-competitive. This cost reduction, combined with established expertise, positions Chinese suppliers to be the primary beneficiaries of the humanoid robot boom, assuming the boom actually materializes.

Sources state that Tesla’s Fremont facility will continue vehicle production, with mass manufacturing of the refreshed Model 3 and Model Y continuing alongside Optimus production. Lily Salwan, speaking for the city of Fremont, emphasized that the retooling won’t result in job losses and that headcount may actually increase. The city was selected as Tesla’s Optimus hub due to its proven ability to support large-scale, complex manufacturing operations, skilled workforce, and business-friendly administration.

However, questions remain. The humanoid robot market is speculative, with no proven demand at the scale Tesla is planning.

The company is betting that organizations will purchase robots at volumes that justify million-unit annual production runs. If that bet pays off, Chinese component suppliers are positioned to reap substantial rewards. If it doesn’t, they’ll have invested heavily in production capacity for a market that may take years longer to develop than anticipated.