The entertainment industry faces a troubling paradox: while audiences retreat to familiar comfort viewing and automated content floods platforms with minimal effort, investment in original programming is producing diminishing returns.

Research from Kapwing reveals a startling truth about the modern content ecosystem. Analysis of YouTube‘s recommendation algorithm shows that roughly one-fifth to one-third of videos served to new users consist of either AI-generated material or what researchers term “brainrot” content. These are compulsive, low-quality videos that captivate attention without offering substance.

The numbers tell a stark story. Among the top 100 trending YouTube channels across various countries, AI-generated content has secured massive audiences. Spain alone hosts 20.22 million subscribers following such channels among its trending content creators. The United States ranks third globally with 14.47 million subscribers to similar operations.

These aren’t small operations generating modest returns. Bandar Apna Dost, an Indian channel featuring computer-generated videos of a monkey in human situations, has accumulated enough views to generate an estimated $4.25 million in annual advertising revenue. The South Korean channel Three Minutes Wisdom, which primarily shows photorealistic animals in staged confrontations, brings in approximately $4 million yearly.

The scale of this automated content production has created what researchers call “AI slop.” It is material generated through automatic computer applications and distributed primarily to accumulate views and subscriptions. Wiktionary defines a “slopper” as “Someone who is overreliant on generative AI tools such as ChatGPT; a producer of AI slop.”

YouTube CEO Neal Mohan has described generative AI as the biggest transformation for his platform since the original recognition that regular people wanted to watch each other’s videos. “The genius is going to lie whether you did it in a way that was profoundly original or creative,” Mohan told Wired. “Just because the content is 75 percent AI generated doesn’t make it any better or worse than a video that’s 5 percent AI generated. What’s important is that it was done by a human being.”

Yet the platform faces a fundamental tension. While YouTube embraces AI as a creative tool, advertisers worry about their brands appearing alongside low-quality automated content. The Guardian’s analysis found that nearly one in ten of the fastest-growing YouTube channels globally feature only AI-generated material.

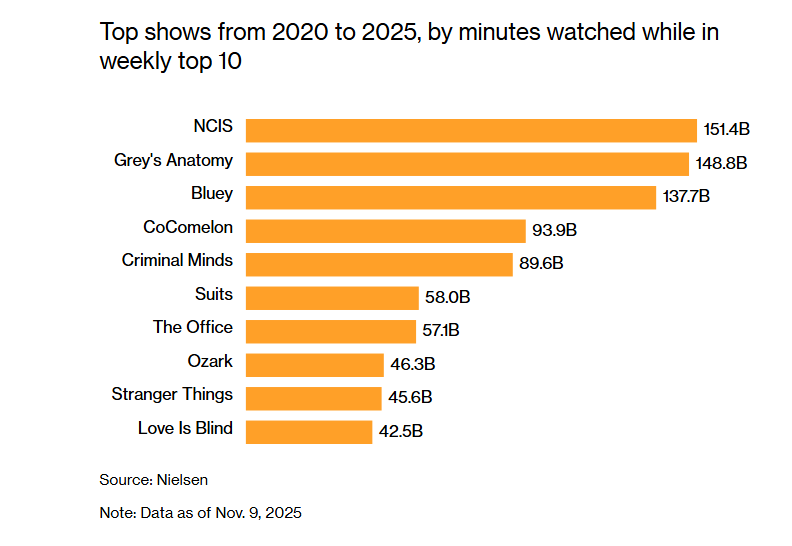

This surge in automated content arrives precisely as audiences demonstrate decreasing interest in discovering new television programming. Analysis of Nielsen viewership data reveals a dramatic shift in consumption patterns.

Traditional network programs like NCIS and Grey’s Anatomy continue to dominate, accumulating 151.4 billion and 148.8 billion minutes of viewing time respectively over the past five years.

The children’s program Bluey has become a cultural phenomenon, ranking as the most-watched show overall in 2025 with 137.7 billion minutes viewed across multiple years. CoComelon, another children’s title, accumulated 93.9 billion minutes during the same period.

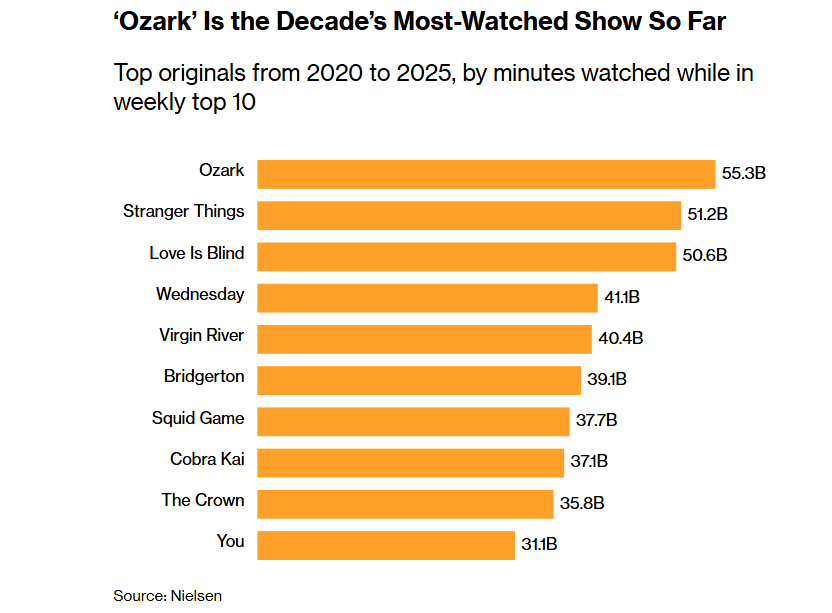

Perhaps most concerning for Hollywood studios: not a single new series appeared among the ten most-watched original programs in 2025. Every entry consisted of returning properties, many approaching their final seasons.

The top originals of the past five years include Ozark, Stranger Things, Love Is Blind, Wednesday, and Virgin River. However, audiences increasingly default to these established franchises rather than sampling fresh offerings.

The economics of attention have fundamentally changed. YouTube has become the most-used platform on American televisions, surpassing Netflix and Amazon combined. Free, advertising-supported services now account for more than 40% of all viewing time as audiences resist rising subscription costs.

Netflix still dominates prestige programming, responsible for roughly two-thirds of top-performing originals. However, its overall market share has declined below 20% as competition fragments viewership. Disney’s platform, despite an explosive launch, has seen its growth stall, with viewing share barely increasing over three years.

The proliferation of automated content creates what researcher and artist Eryk Salvaggio describes as information exhaustion: “information of any kind, in enough quantities, becomes noise.” Studies have demonstrated the “illusory truth effect,” showing that repeated exposure to claims or imagery makes people more likely to believe them, regardless of accuracy.

“The prevalence of AI slop is a symptom of information exhaustion, and an increased human dependency on algorithmic filters to sort the world on our behalf,” Salvaggio writes. As automated content drowns out carefully crafted work, the value of trustworthy sources rises, creating opportunities for both legitimate creators and those seeking to manufacture false credibility.

The contrast between cheap, automated content and expensive original programming has never been sharper. While Spanish-language channel Imperio de jesus, promising to strengthen “faith in Jesus through fun interactive quizzes,” accumulates millions of subscribers with minimal investment, major studios pour resources into shows that audiences increasingly ignore.

South Korea leads globally in views of AI-generated content with 8.45 billion, nearly 1.6 times the second-place nation. The country’s trending AI channels include eleven operations among its top 100, though Spain’s eight channels command the largest subscriber base.

The United States-based channel Cuentos Facinantes [sic], featuring low-quality Dragon Ball-themed videos, has attracted 5.95 million subscribers despite launching its current content catalog only in January 2025. The channel’s earliest hosted video dates from just months ago, yet it has accumulated 1.28 billion views.

For traditional media companies, the implications are severe. Audiences demonstrate clear preferences for familiar content, whether classic network dramas, animated children’s programs, or the endless scroll of algorithmically-recommended videos. The appetite for premium subscriptions and experimental storytelling appears to be contracting just as production costs for quality programming continue rising.