The crypto world is no stranger to deception, and Hayden Davis appears to be making headlines yet again. After orchestrating the notorious Libra rugpull and launching the dubious Melania token, Davis has resurfaced with yet another project—this time under even greater scrutiny from blockchain sleuths.

A Trail of Deception

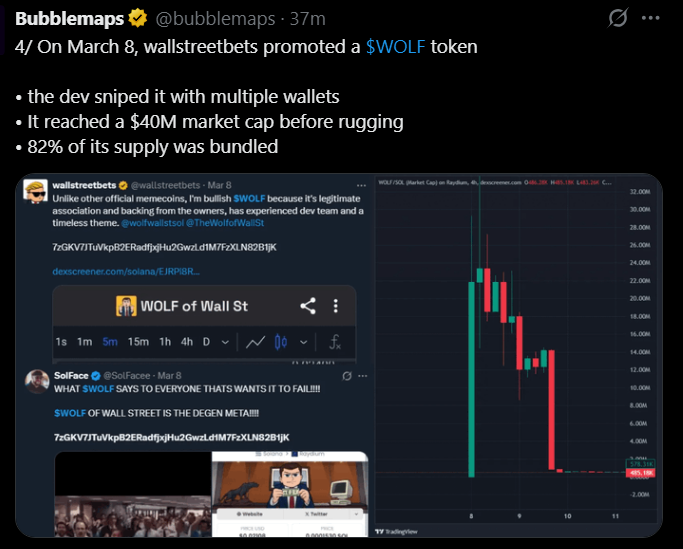

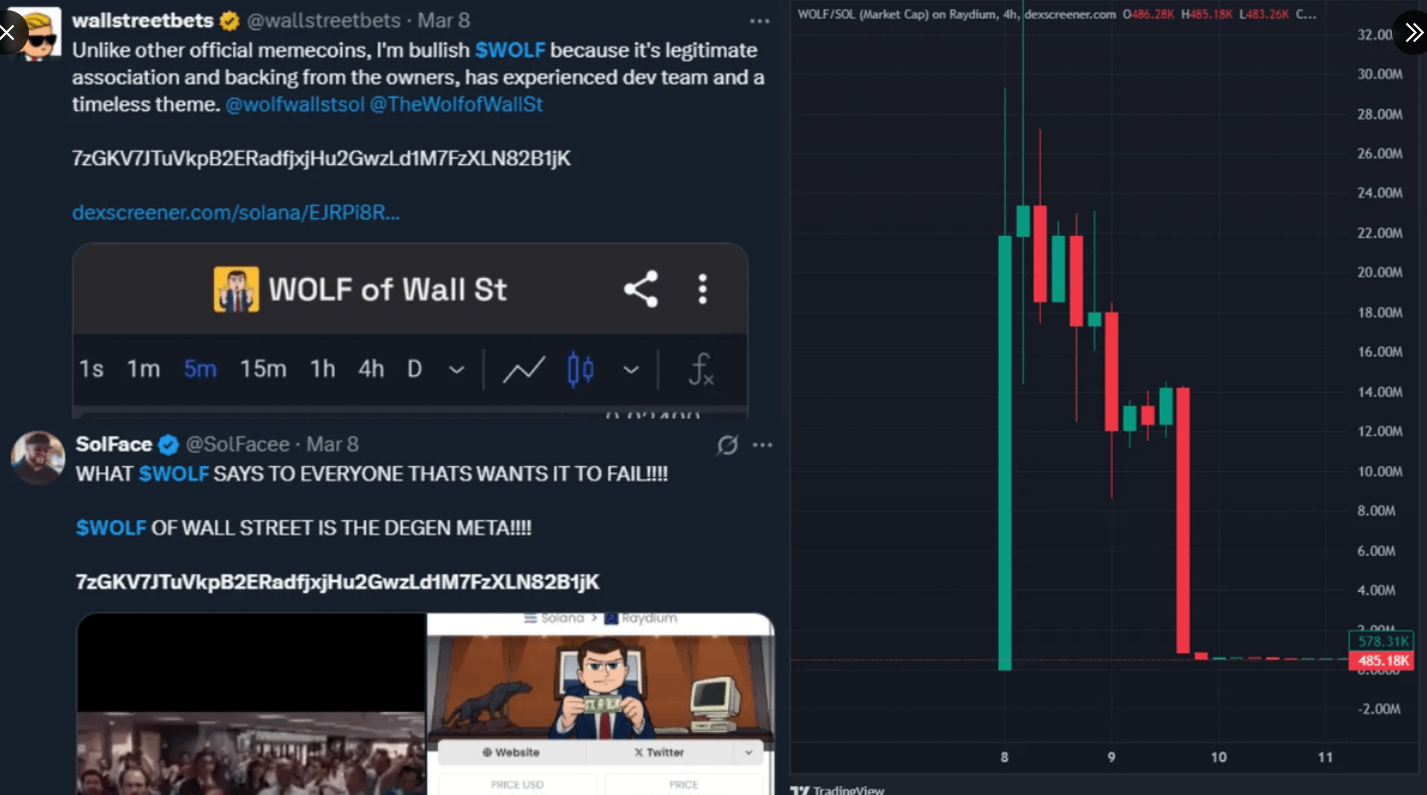

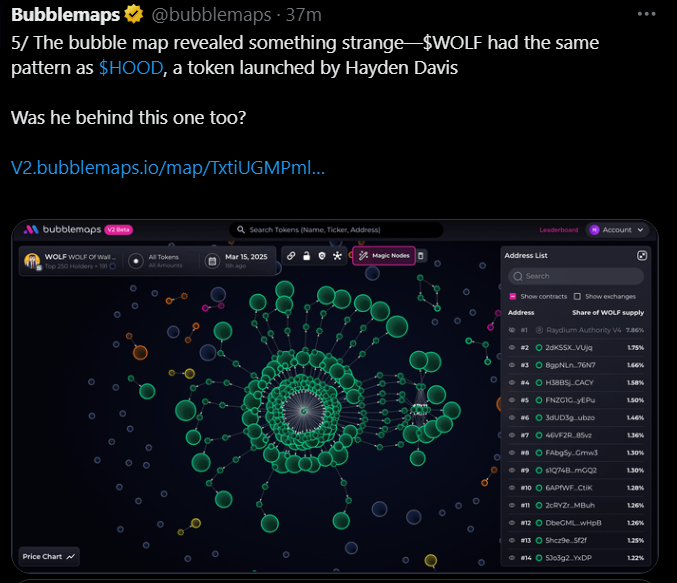

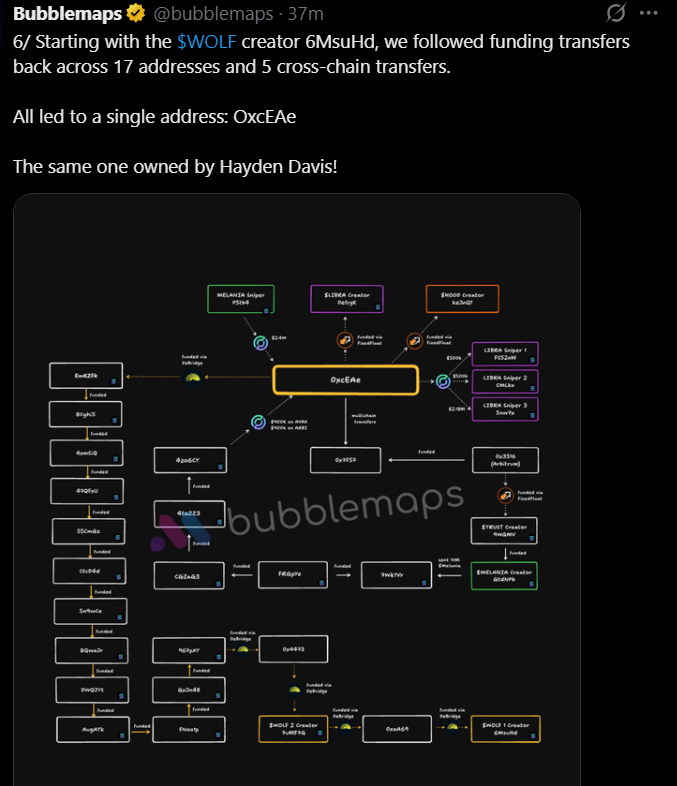

Blockchain analytics firm Bubblemaps has exposed Davis’s latest attempt at launching a token, this time called $WOLF. According to their analysis, Davis meticulously funneled funds across 17 different addresses and five cross-chain transfers in an effort to obfuscate his involvement.

Yet, the digital breadcrumbs still led back to him.

The Bubblemaps investigation traced the funding of $WOLF directly to an address: OxcEAe—the same address tied to Davis in previous fraudulent projects. Despite the increasing attention on his activities, Davis appeared confident that he could evade detection by orchestrating these transactions months in advance, using multiple layers of transfers to create distance between himself and his new venture.

Pattern of Fraud

This isn’t the first time Davis has been linked to a high-profile crypto scheme. His involvement in the Libra rugpull left investors reeling, with significant losses reported after the project collapsed. Additionally, his ties to the Melania token, an opportunistic project capitalizing on the former First Lady’s name, raised red flags in the industry. Both projects have reinforced his reputation as a serial crypto scammer.

Despite these scandals, Davis appears undeterred. The launch of $WOLF suggests a deliberate pattern—quickly spinning up new tokens, using elaborate methods to disguise his involvement, and capitalizing on crypto investors’ short memory and constant hunger for the next big project.

Can Scammers Still Get Away With It?

With on-chain investigators and analytics platforms like Bubblemaps becoming more effective at uncovering these schemes, one has to wonder: Why does Davis keep trying?

The answer may lie in the lucrative nature of these rugpulls. Even with increased scrutiny, many investors fail to conduct due diligence, falling prey to hype and FOMO. Scammers like Davis exploit this vulnerability, knowing that even if one project gets exposed, another can quickly rise in its place.

However, as blockchain forensic tools become more advanced, it is becoming increasingly difficult for bad actors to escape unscathed. The exposure of Davis’s latest scheme might signal the beginning of a more robust crackdown on repeat offenders in the space.

For now, investors should remain vigilant, scrutinizing projects thoroughly before committing their funds. The crypto industry is still rife with bad actors, and as Davis’s history shows, they will stop at nothing to stay one step ahead.

1/ Hayden Davis launched a new token: $WOLF

Now on an Interpol notice, the creator of LIBRA and MELANIA tried his best to hide it ↓ pic.twitter.com/Ok6ev3JH4r

— Bubblemaps (@bubblemaps) March 15, 2025