At CES in Las Vegas, Nvidia founder and CEO Jensen Huang addressed over 6,000 attendees in person and millions watching globally to explain the massive financial influx powering the artificial intelligence revolution.

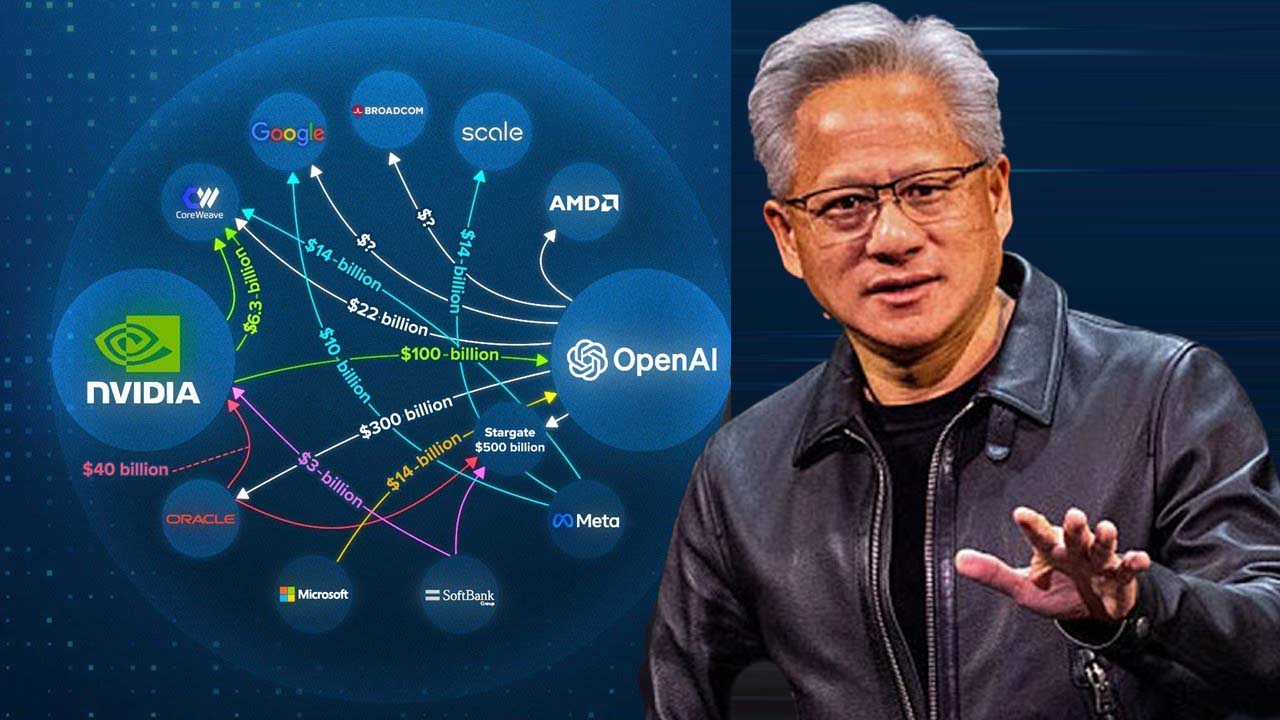

Huang was likely prompted to make this explanation due to rising concerns about AI being a bubble. The artificial intelligence industry has constructed an elaborate web of circular investments that increasingly resembles a financial house of cards. Companies at the center of the AI boom have been investing billions of dollars in each other, creating interconnected relationships that make it difficult to determine where genuine demand ends and mutual subsidization begins.

Nvidia invests in companies that purchase Nvidia chips. OpenAI secures infrastructure deals with suppliers who simultaneously take equity stakes in OpenAI. Amazon funds Anthropic, which then commits to using Amazon’s cloud services and custom chips. Google provides both capital and computing resources to Anthropic while benefiting from its adoption of Google’s technology. These arrangements create a feedback loop where the same capital cycles through the ecosystem, potentially inflating revenue projections and purchase orders.

Huang opened by addressing the elephant in the room:

“People ask where is the money coming from?”

His answer centered on what he described as two simultaneous platform shifts happening for the first time in computing history.

“Every 10 to 15 years the computer industry resets,”

Huang explained.

“Except this time there are two simultaneous platform shifts in fact happening at the same time. While we now move to AI, applications are now going to be built on top of AI.”

The fundamental change goes beyond just new applications.

“The entire fabulary stack of the computer industry is being reinvented. You no longer program the software, you train the software. You don’t run it on CPUs, you run it on GPUs.”

This complete overhaul means existing infrastructure must be modernized.

“Some 10 trillion dollars or so of the last decade of computing is now being modernized to this new way of doing computing,”

he stated.

“What that means is hundreds of billions of dollars, a couple hundred billion dollars in VC funding each year is going into modernize and inventing this new world.”

But venture capital represents just one stream. Huang pointed to an even larger source, corporate research and development budgets.

“A hundred trillion dollars of industry, several percent of which is R&D budget is shifting over to artificial intelligence,”

he explained.

“That’s where the money is coming from. The modernization of AI to AI, the shifting of R&D budgets from classical methods to now artificial intelligence methods.”

The CEO traced AI’s recent evolution, from the 2015 BERT language model through the 2022 ChatGPT moment that

“awakened the world to the possibilities of artificial intelligence.”

He highlighted the 2023 emergence of reasoning models as particularly revolutionary, introducing what he called “test time scaling,” which he described as

“another way of saying thinking.”

Huang detailed how each phase of AI development requires massive computational resources. The demand has exploded across three dimensions: pre-training models that grow tenfold annually, post-training with reinforcement learning, and inference that now involves extended reasoning rather than single-shot answers.

“The number of tokens you can just see the AI think which we appreciate. The longer it thinks oftentimes it produces a better answer,”

he noted.

The cost dynamics create urgency.

“Every time they get to the next frontier, the last generation AI tokens, the cost starts to starts to decline about a factor of 10x every year,”

Huang said.

“Everybody’s trying to get to the next level and somebody is getting to the next level. And so therefore, all of it is a computing problem. The faster you compute, the sooner you can get to the next level of the next frontier.”

This computing race explains Nvidia’s relentless pace of innovation and why the company is

“so busy,”

as Huang put it. The massive infrastructure investments flowing into AI represent not speculation but necessary modernization as entire industries shift their technical foundations and research spending toward artificial intelligence capabilities.