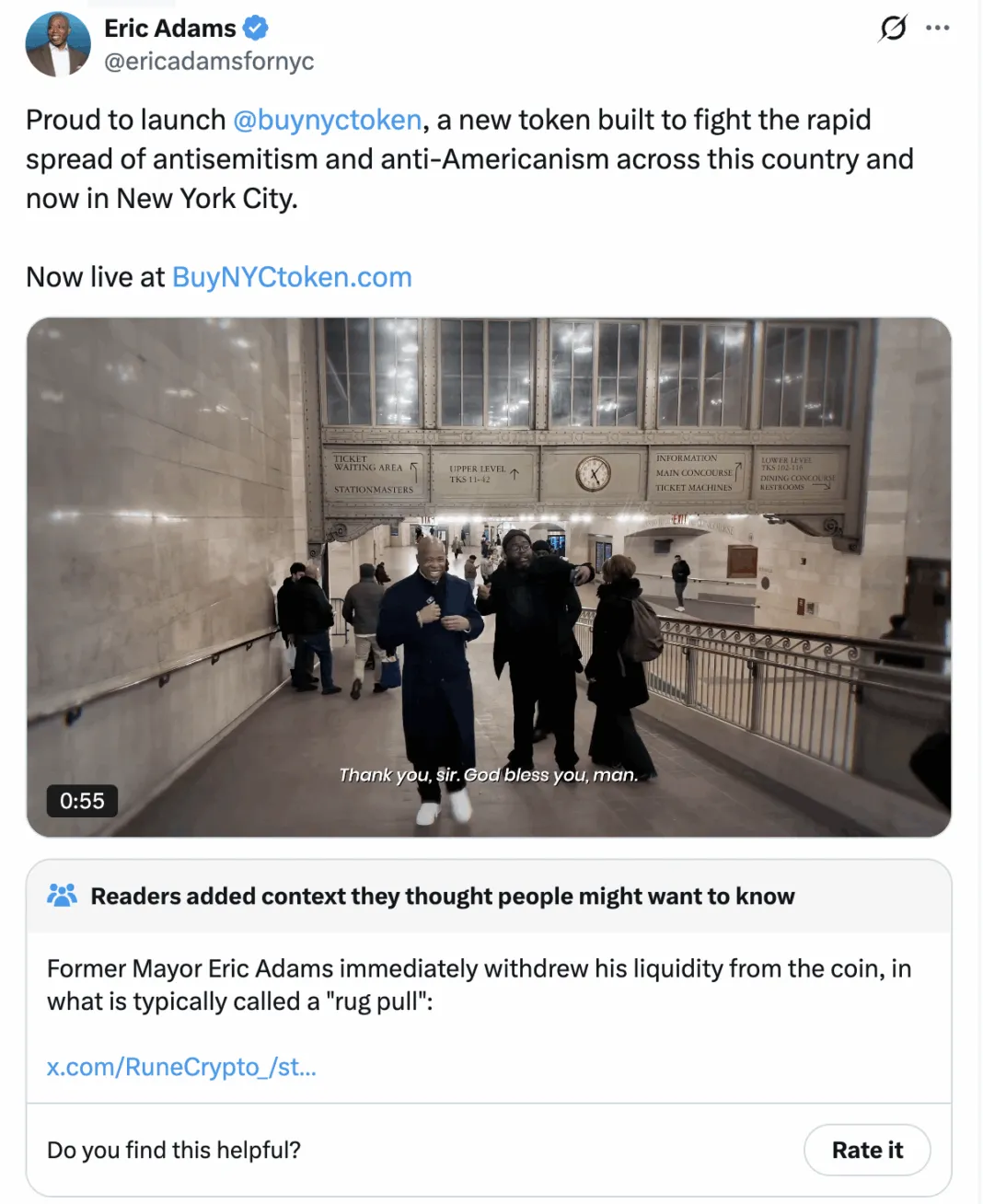

Former New York City Mayor Eric Adams launched a cryptocurrency token that promised to fight anti-semitism and make the city safer. Instead, investors claim they were scammed out of $2.5 million when liquidity was suddenly removed from the New York City Token.

“By using this New York City token, we’re going to continue to invest in making our city a safer city. I am not going anywhere,” Adams declared at the launch. Hours later, the money appeared to go somewhere entirely different.

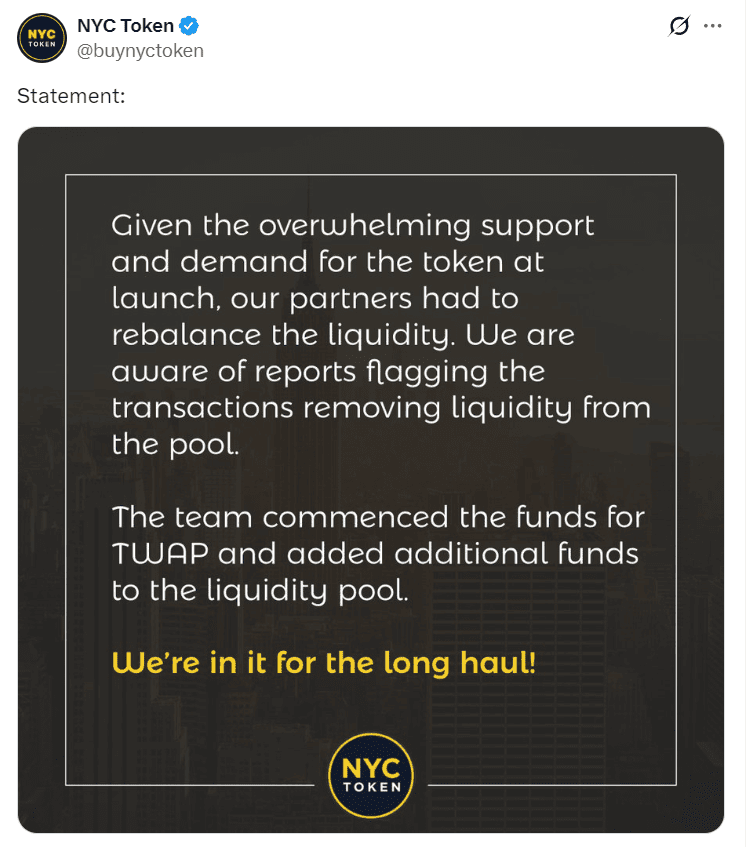

The official team responded to allegations by stating, “Given the overwhelming support and demand of the token, our partners had to rebalance the liquidity. We are in it for the long haul.” While some funds have returned, $1.4 million remains in the account that removed the liquidity, leaving investors questioning whether they’ll see the rest.

According to sources, the token’s chart tells a troubling story. After reaching over $100 million in market cap, the value plummeted dramatically. Adams had confidently stated, “We were about to change the game,” shortly before the collapse. The game certainly changed, just not in the direction investors expected.

The project appears hastily assembled with minimal transparency. The website promises to reveal the team eventually but hasn’t done so. Control of the treasury will supposedly be disclosed publicly, but that information remains absent. The initiative claims to support charitable causes without specifying which ones.

The token distribution raises additional concerns. While 8% of the original allocation is intended for trading, investors face potential dilution over 10x through the NYC token reserve, assuming it’s actually used as the team claims it won’t be.

Eric Adams, currently facing bribery and campaign finance charges, is hardly positioned as a champion for everyday investors. The project released promotional videos featuring the mayor emerging from a taxi, suggesting the token could be used for fares. Yet the website’s terms explicitly state that “memecoins like New York City token are never intended to have any monetary value, any market value, utility, or functionality. Memecoins are not an investment.”

This contradiction exemplifies the problematic nature of celebrity memecoin launches. Publicly, promoters suggest real-world utility and investment potential. Legally, they disclaim any actual value or purpose.

Perhaps most concerning is the token structure itself. Creators and C18 Digital receive significant percentages, while 70% sits in a reserve supposedly locked forever. However, later documentation suggests this reserve might actually be accessible, contradicting earlier claims about permanent lockup.

The New York City Token has no official affiliation with New York City government. Its only distinguishing feature is Adams’s involvement as former mayor, now leveraging the city’s brand to promote a speculative digital asset.

These memecoin launches follow a predictable pattern: insiders structure deals to benefit themselves while retail investors bear the risk. The zero-sum nature means that for every winner, there are far more who experience losses.